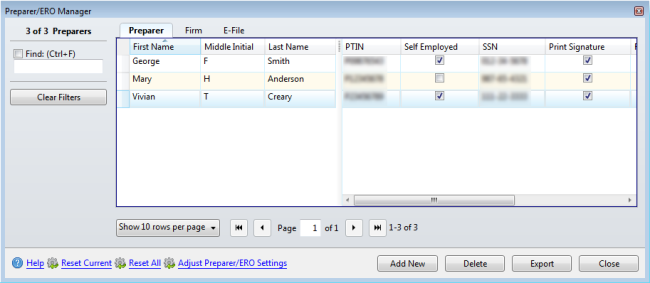

Adding Preparer/ERO Information

You can enter an unlimited number of preparers in Preparer/ERO Manager. However, to be able to sign in and use the system, an individual must be set up as a user in Security Manager. See Adding Users to the System.

To add preparers and/or EROs to the system:

- From Return Manager, do one of the following:

- Click the Preparer/ERO button on the toolbar.

- Click the Tools menu; then, select Preparer/ERO Manager.

Preparer/ERO Manager

- Click Add New.

- Enter the preparer or ERO information.

- Click Close.

Preparer/ERO information that is added directly to a return will not be saved in the Preparer/ERO Manager.

Special ID Numbers for States

NYTPRIN for New York State Preparers

New York State tax preparers must register each year with the New York State Department of Taxation and Finance to receive a New York Tax Preparer Registration Number (NYTPRIN). In order to have the NYTPRIN automatically added to returns, you must enter this number in the NYTPRIN column on the Preparers tab of the Preparer/ERO Manager. For more information on the NYTPRIN, visit http://www.tax.ny.gov/tp/tpreg.htm.

Preparers who are exempt from the NYTPRIN should use the drop-down list to select the exemption code from the NYTPRIN Excl column on the Preparers tab of the Preparer/ERO Manager.

NM CRS for New Mexico Preparers

Anyone engaged in business in New Mexico must register with the Taxation and Revenue Department. As part of registration, the business receives a state tax ID number known as a Combined Reporting System (CRS) number. This registration is the main method for reporting the State’s major business taxes.

Preparers who receive a W-2 from a tax preparation firm or company do not need a CRS number; they should use the firm’s CRS ID Number when preparing returns. Contractors must apply for their own CRS ID Number, and should not use the firm’s CRS number.

To apply for a CRS ID number or for more information on the topic, visit www.tax.newmexico.gov.

See Also:

Printing Preparer Signatures on Returns